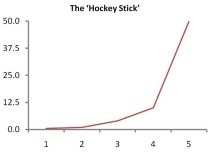

How long does it take to build a successful company?

It’s common for investors to receive business plans showing sales growing from 0 to $50m in the first 5 years of a company’s life. This generally leads to 'tense' conversations about growth between investors and entrepreneurs

One of the reasons for this standoff is that people from both groups tend to have unsubstantiated expectations about how long it takes to build a successful company.

Maybe these conversations would be easier if we simply knew how long it takes to build a successful company? The Wall Street Journal posted this visualisation that compares the performance of the 100 largest publicly traded software companies across more than three decades.

[CLICK ON THE CHART BELOW TO INTERACT WITH DATA]

Key Findings

- Even among the most successful US tech companies, it still takes and average of 8 years to reach $50M in revenue. The number is certainly a gross underestimate, because it doesn’t include any of the companies that did not IPO, failed, or were not in the top 100

- Half of the 100 companies took nine or more years to reach $50 million

It makes you wonder: Is it wise to prepare a business plan featuring steep hockey stick sales projections?

About the study

The study is based on the top 100 publically traded software companies. All of the sales numbers have been inflation adjusted, so we can compare the performance of a company founded in the 80’s (e.g., Adobe) to one founded a few years ago (e.g., Salesforce.com).

It separates out by colour those that are “rocket ships” (red) companies that reach $50 million in annual sales in six years or less, “hot companies” (orange) companies with $50 million in revenue in the first seven to 12 years, and “slow burners” (blue) companies which take 13 years or more to hit $50 million.